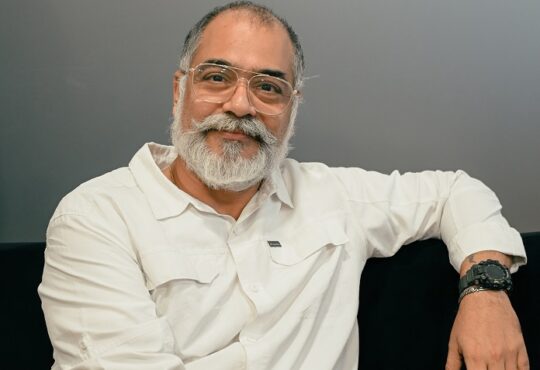

CXOToday has engaged in an exclusive interview with Mr. Kamal Mehta Promoter Director Parrami Finance Private Limited.

Modi government has made significant restructuring in the MSME ecosystem and what are the next restructuring required in line with lending it to the MSME ecosystem?

Ans: According to official government data, as of March 2021, there were over 1.5 crore (15 million) registered MSMEs in India. These include businesses that have registered under the MSME Act and are eligible for various benefits and support schemes and estimating the number of unregistered MSMEs can be more challenging due to the informal nature of many small businesses in India. The recent definition of MSMEs in India has been changed along with special provisions under the Insolvency and Bankruptcy Code (IBC) to facilitate faster resolution of MSME insolvencies, strengthening Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), subordinate debt scheme to support MSMEs that are stressed or classified as NPA (Non-Performing Assets) etc and these measures collectively aim to enhance the competitiveness, financial stability, and growth potential of MSMEs in India however as per the data from the Reserve Bank of India (RBI), as of 2021, only around 30-40% of MSMEs in India were estimated to have access to credit from formal financial institutions like banks and NBFCs because of multiple reasons

1) Banks often have stringent lending norms and policies that are not MSME-friendly

2) lack of knowledge leads to poor financial planning and management, making them less attractive to lenders

3) For banks and NBFCs, the cost of processing and servicing small loans can be high relative to the loan amount, making such loans less attractive

4) Many MSMEs have poor or no credit history, making it difficult for banks to assess their repayment capability

5) Many MSMEs operate informally without proper financial records, making it difficult for banks and NBFCs to assess their creditworthiness

6) MSMEs often lack sufficient collateral to secure loans, which is a major requirement for traditional bank lending

7) Financial institutions perceive MSMEs as high-risk borrowers due to their small size, limited assets, and vulnerability to market fluctuations etc and more interestingly to meet the priority sector lending targets leading PSU lends to only large MSMEs who meets their criteria and in other hands borrowing rates for NBFCs are higher hence lending rates are higher and in many cases lending rates to MSMEs much more higher than housing loan, two wheeler loan etc. Hence government should make a provision that all government banks should include a certain percentage of new MSMEs each year as their new borrowers.

In a recent political campaign government claimed that have done many things for MSMEs and in the other hand data says only XYZ % of MSMEs are under a formal financial system hence my question is why such gaps and how should it be bridged?

Ans: As per the data from the Reserve Bank of India (RBI), as of 2021 60% to 70% do not have access to credit from formal financial institutions like banks and NBFCs and things are not so simple as complexity differs from one to other MSME hence India needs to have customized flexible lending norms with a lower rate of interest for MSME credit.

As a new NBFC what are your expectations from the newly formed government in perspective of providing financial help to MSMEs compared to banks?

Ans: Creating an infrastructure, Easy process, and eligibility criteria to avail the fund for MSMEs that will benefit MSMEs to avail the services at a competitive rate of interest.

NPA in TREDS is negligible but still why NBFCs are not focusing on it?

Ans: Trade Receivables Discounting System (TReDS) is an invoice discounting platform where many NBFC are participating however to meet the priority sector lending targets government banks are more aggressive in these platforms and they lend it to a list of MSMEs who all are providing their goods and services to top category corporates however as an NBFC we do much beyond for our MSME ecosystem, we do purchase bill discounting, sales bill discounting, business loans to MSMEs and corporate loans for corporate.

Your targets for FY 24-25.

Ans: Parrami Finance is working on enhanced digitisation of its processes and has set a target of 30% YoY growth in the disbursement of sales bill discounting, purchase bill discounting, MSME Business Loan, Corporate Business Loan, and customer onboarding for the current financial year.