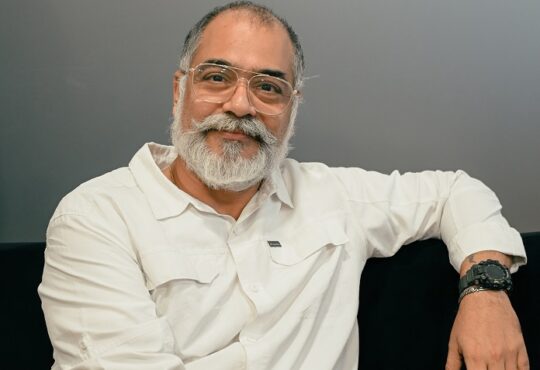

CXOToday has engaged in an exclusive interview with Mr. Amjad Raza Khan, CEO Of Cashaa

- Could you elaborate on the specific strategic changes Cashaa is implementing to expand its reach?

We have shut down our business banking vertical as of 30th May 2024. Although Cashaa made its name as the world’s foremost crypto banking company by onboarding and servicing over 500 businesses in the crypto sector in the last 5 years, this segment did not really benefit our native token CAS. Now we will be using the same infrastructure and skill set to service millions of retail customers with products and services that can benefit the CAS token and drive its adoption at scale. There have been other tech and operations related changes that have been made to make our systems and processes smoother, more efficient and scalable, while not compromising on security and compliance measures.

- How do you plan to attract and retain millions of new users during the upcoming bull market phase?

With extensive marketing and customer outreach efforts, we wish to establish Cashaa as a household name. Given that Cashaa has transitioned to a new business vertical targeting retail customers, we expect to face challenges in reaching a broader audience, educating them about the benefits of crypto and Cashaa, and keeping them engaged. We plan to overcome these challenges through an extensive and tailored marketing campaign that focuses on customer outreach and education.

- How is Cashaa ensuring compliance with global regulatory standards in its expansion plans?

Cashaa has always ensured strict adherence to compliance as well as following best practices above and beyond regulatory standards to ensure safety of customer funds and continuity of operations. We haven’t received a single sanction in our almost 8 years of existence in the crypto sector. We are licensed in Europe and follow strict security, privacy and KYC policies at all times.

- What measures are being taken to enhance the growth and utility of the CAS token within the ecosystem?

We are committed to ensuring that all of Cashaa’s products and services offer utilities for the CAS token, with the best features being exclusively available to CAS holders. This strategy aims to incentivize the adoption of CAS and provide a glimpse of the benefits users might miss if they do not hold the token.

- How do you envision the CAS token evolving to better serve the new retail segment?

With increasing adoption of Cashaa wallets and the CAS token in particular, CAS can evolve to become a utility token as well as a medium of exchange for Cashaa users. Doing the same everyday transactions that you do with fiat, can eventually be done using CAS tokens, but at a fraction of the cost.

- What changes are being made in Cashaa’s corporate structure, and how will these changes support the company’s new direction?

All of the major divisions including technology, operations, marketing, sales, support, compliance, human resources, etc., have been properly segregated and insulated in our new corporate structure to ensure no conflicts of interests. For example, sales and support are being kept completely separate and independent from operations and compliance.

- How do you plan to maintain the company’s historical strengths and the trust it has built within the industry during this restructuring process?

Except for the change in the top post, the rest of the core team remains the same. Most of the team has been here since more than 4-5 years and have been an integral part of achieving what you call as Cashaa’s historical strengths. While the product segment has changed, the core infrastructure in terms of technology, operations and support remain the same. We are adding on top of the core infrastructure to ensure scalability without compromising on security and service quality.